Matti Rautkivi – General Manager, Market Development, Wärtsilä – lives and works in Houston, Texas. He is in an excellent position to follow the development of the US electricity market.

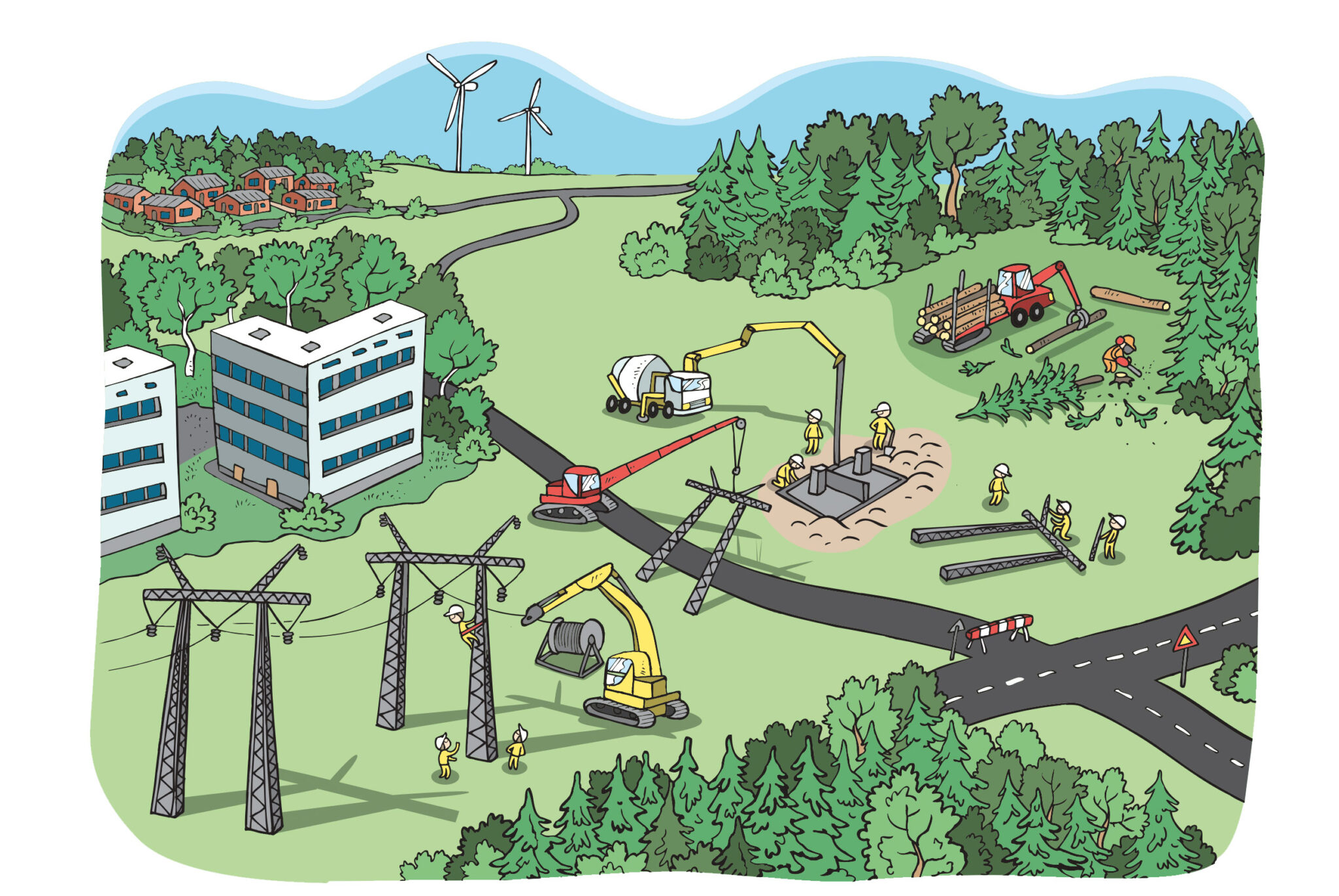

Rautkivi points out that the US has no uniform electricity market, but systems and the focus of energy policies may vary from one state to another. However, great, macro-level changes include the strong appearance of renewable energies.

”Plenty of wind power in particular has appeared in the Mid-West, while a huge amount of solar power has been commissioned in the west and south of the country. The amount of renewable energy keeps increasing – not so much due to environmental but more about economic reasons.”

”Renewable energy is affordable. Very cheap gas is also available. For example, no-one is planning to invest in coal any more, even though the current US president has been hinting at it. In fact, coal will be replaced by investing in renewable energy and flexible gas power capacity.”

Price signal guiding the market

According to Rautkivi, people in the US understand that the country’s energy system is undergoing a huge change.

However, politicians do not – mainly – direct which kind of capacity the country will need in the future. In terms of energy economy guided by the market, Texas is furthest ahead.

”Here, the market is viewed in its entirety according to the ’energy only’ principle, focusing on how the market could give market players the most correct price signal to build capacity needed by the system. Furthermore, capacity that is of the wrong kind or out of date will exit from the market if it isn’t profitable, making room for new capacity and new players.”

Everything is huge in Texas – price fluctuations included

Unlike in Finland, there is no TSO in Texas, but the system is run by a system operator.

”On the previous day, the operator checks the situation for the following day, accepting offers for energy production. In addition, there is a real-time market in use, where the price of electricity is determined every five minutes.”

Because the real-time price fluctuates quite a lot, in part according to how much renewable energy is available at the time, it creates markets for flexible capacity, as well.

”The average price on the real-time market is, however, lower than on the day-ahead market. The reason is that operators want to protect themselves against real-time price spikes and are ready to pay a premium for this protection on the day-ahead market.”

This also brings us to Wärtsilä’s business. Wärtsilä’s product portfolio includes, for example, flexible gas power plants, which can be started up, and similarly shut down, very quickly.

Demand is also flexible

Texas is a long way ahead in demand response, as well. It is also directed on a market basis.

”A company operating in the sector can contact Walmart, for example. The company can offer to decrease the energy consumption of a store during price spikes by, say, 20 per cent, if it receives half of the money saved in this manner. It can bring and install its own machines at the store for this purpose, so that Walmart avoids any investment costs.”

Learn from America?

In Finland and Europe, the goal is a controlled transition to a green and emission-free electricity system. Could we learn something from the Texan model?

”I am a staunch ’energy only’ man myself. It’s been great to see here how cleaner energy and the necessary balancing power has been commissioned on a market basis, by taking into consideration the correct price signal. The ’energy only’ principle has also meant cheaper electricity for consumers, when people have understood that price isn’t the same thing as cost.”

In Finland, however, there has lately been talk that, for example, changing the imbalance settlement period from one hour to fifteen minutes would require large investments in meters.

”The market needs to be viewed as an entirety; don’t stop and wonder about some individual problem or service that doesn’t exist yet. If the correct market signal is formed, new business models will also appear – and it will become profitable for some to install new meters, for example,” emphasises Rautkivi.

”A system where politicians decide how energy will be produced in the future and how we will prepare for a certain capacity is, of course, a very safe option. But then we can forget about the market,” he adds.