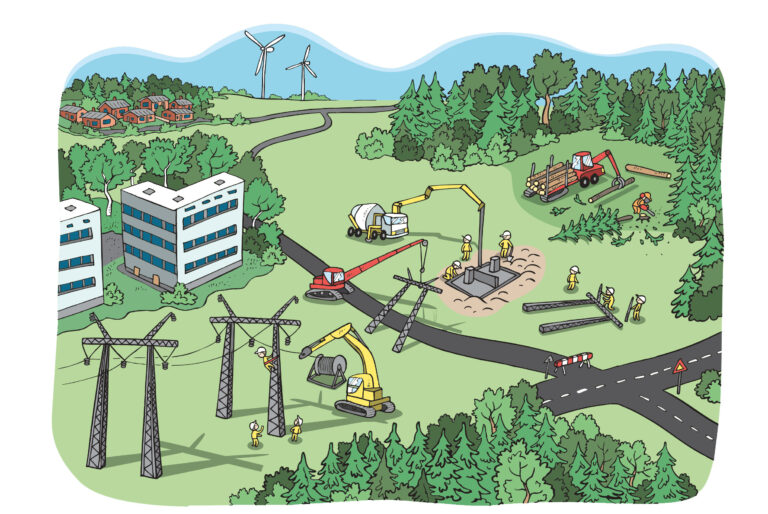

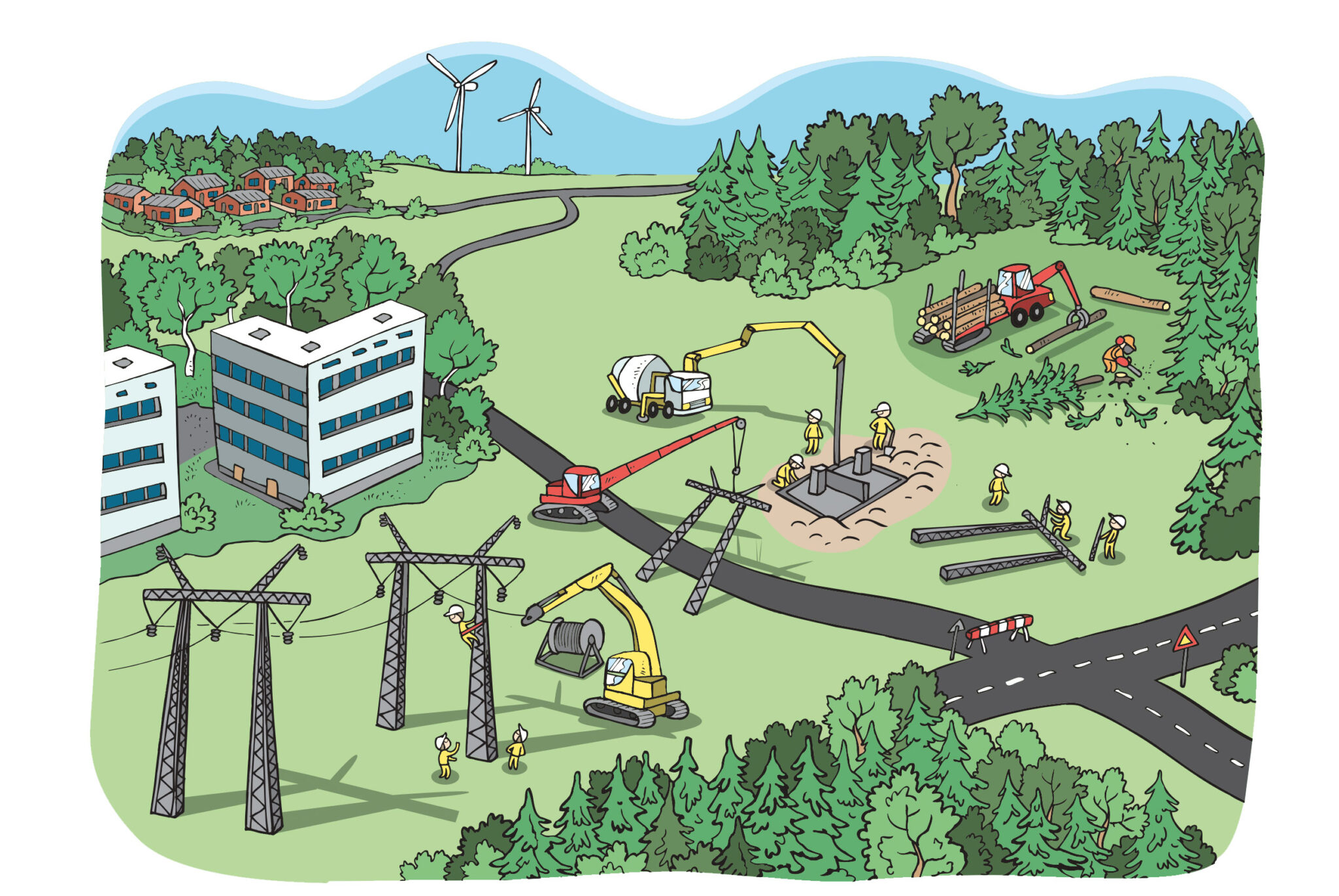

Various products are traded in the reserve market to ensure there is enough electricity to cover consumption, electricity is not over-produced, and the grid frequency remains within the allowed limits. The rapid increase in weather-dependent power production has made this a more demanding task.

Various operators can earn money by offering flexible production, consumption or grid electricity storage in the reserve market. This maintains the balance of the power system cost-effectively.

Hyrdoelectric power is a natural reserve

Fortum has a comprehensive palette of electricity and heat production plants and also participates in the reserve markets.

“In principle, all the capacity that Fortum can use for any market is offered there. We endeavour to deliver maximum added value for society and the company through our capacity,” says Mikael Heikkilä, Senior Portfolio Manager.

Participation in the reserve market is justified.

“It is in the company’s interest that the power system works properly and society can depend on electricity as its main end of use energy source. In addition, we receive financial compensation for reserves,” he continues.

Heikkilä is especially familiar with hydroelectric power plants for electricity production and as reserves.

“The volume of water is limited, so hydroelectric power plants sometimes need to be driven at high capacity and sometimes at lower capacity. This is how reserves naturally arise.”

The turbines in hydroelectric power plants can be regulated over a large power range, supporting the provision of reserves. Investments in automation also support market participation. For example, the Oulujoki River has seven hydroelectric power plants and a power regulation capacity of approximately 400 megawatts.

The flexibility provided by hydroelectric power is important for the power system, but other technologies are also needed. Heikkilä has his sights set on electricity consumption, as the power system needs flexibility in different situations.

He says that reserve products have improved the quality of electricity in terms of frequency, but the large number of products already leads to fragmentation in the procurement process. Heikkilä also has a development idea:

“Would it be possible to develop a secondary market for reserve capacity? This could ensure that the system is cost-effective and the quality of electricity is good.”

Tampereen Energia invests in electric boilers

Lielahti power plant, aistenlahti biopower plant and Tammervoima, which is powered by the municipal waste of 600,000 residents, are the plants owned by Tampereen Energia which are capable of participating in the reserve markets.

Lielahti burns natural gas and has a net electrical power of 142 megawatts, Tammervoima has 12 megawatts, and the biopower plant has 52 megawatts. Last year, a 40-megawatt electric boiler in Lielahti was connected to the district heating network.

Senior BI Specialist Marko Ketola can see useful features in an electric boiler for emission-free heat production and participation in the reserve market.

“The electric boiler can be adjusted quickly, but the connection to the district heating network causes a slight delay. This affects how the boiler can be used in the reserve market,” says Ketola.

In practice, when the power to the electric boiler is reduced, the district heating network must make up the difference from other sources. For this reason, the electric boiler can be adjusted by around one megawatt per minute. This constraint is taken into account when participating in the reserve market.

“We offer the electric boiler in the balancing power market, and it will soon be available for the automatic frequency restoration reserve. Additional investment and balancing tests are still required to control the boiler. In addition, we are considering offering the electric boiler to the frequency containment reserve for normal operation.”

Any use of the boiler for frequency containment will be based on balancing tests. Making contingencies for hybrid threats is also important for Tampereen Energia. The control signal transmitted between the systems of Fingrid and Tampereen Energia must be capable of controlling the electric boiler securely.

The Lielahti electric boiler has been the prime mover, and the company plans to invest in 100 megawatts of additional electric boiler capacity.

“When we have tested the existing electric boiler and determined that everything related to the reserve market works, we can take the action necessary for the next electric boilers during the construction phase.”

Production process determines the form of participation

Outokumpu is Finland’s largest net user of electricity, so it is natural for the company to participate in the reserve market. Mikael Surakka, Energy Manager, reviews the priorities.

“For us, the main business is to make our own product. Our processes and factories have been designed and built for this purpose and were not planned to actively provide demand-side management for various electricity reserve markets.”

Consequently, Outokumpu’s participation in the reserve market is based on how its production processes

can be adapted to suit the rules of the various reserve markets, including factors such as time limits.

The Tornio steelworks has the highest electricity consumption of any single site in the country. Some of the company’s processes allow it to participate in the manual balancing power market. Automatic reserve

products have also been studied, but they are not yet compatible with the production requirements.

“The processes have some technical constraints, and the possibility of participating in the reserve market always depends on the state of production. We need to bear in mind that individual short-lasting actions can have longer impacts.”

Surakka says that in practice, the interplay between the production process and participation in the reserve market requires the continuous monitoring, coordination and response of the process and market. This sets demands on collaboration and information systems in different organisations.

Surakka points out the importance of this matter: Electricity is a necessity in steel production, so the company’s priority is to ensure that it is always available at a reasonable price.

“This incentives us to support the electricity market through our operations. The world has changed, and now electricity consumers also need to respond quickly to changing situations in the electricity market.”

Entering the reserve market with Gasum

Gasum provides a wide range of services for the energy market, although many people still perceive it only as a gas company. In the electricity reserve market, Gasum acts as a service provider to its customers.

“We sell our customers’ capacity to the reserve market, invoicing the incomes from Fingrid, and compensate it to our customers. This model means that Fingrid does not need to conclude agreements with each reserve unit individually,” says Juha Hietaoja, Senior Energy Specialist.

Gasum currently has about 20 customers in the reserve market. The capacities of individual units are typically from one megawatt upwards. They include industries, electricity producers, energy storage facilities and real estate customers.

For example, the standby back-up generators maintained by real estate customers in case of power outages can be offered to the reserve market. Wind power operators, in turn, can commit to reducing their power production for a short period to support the power system.

According to Hietaoja, the potential financial gains are the biggest incentive for customers to participate in the reserve market. On the other hand, the technical requirements and complexity of the market raise the bar for participation.

“Of course, from a national economic perspective, it makes sense to have all possible capacity in the reserve market, especially as renewable weather-dependent production increases.”

At the outset, Gasum identifies how much a customer could benefit from offering their capacity in the reserve market. After that, the required technical capabilities are determined, and acceptance tests are performed. When operations have started, Gasum’s 24/7 control room handles operations in the market around the clock.

“More and more of our customers have the capacity suitable for different markets. We constantly develop our system capabilities and price forecasts for different markets to continuously optimise the market in which capacity should be offered.”

Reserve markets

Fingrid procures reserves from the two

reserve markets it maintains:

IN THE CAPACITY MARKET,

suppliers maintain the volume of reserves that are traded. Compensation is paid for capacity and, in some products, for energy

activation.

RESERVES ARE ACTIVATED

in the energy market. Compensation is paid for the activated energy.