As much electricity must be produced as is consumed at any given moment. To maintain a state of balance in the grid, electricity producers and consumers plan their needs and offerings as accurately as possible in advance and trade on the electricity exchange.

If consumption proves higher than expected or, for example, wind power cannot produce the planned amount of energy, Fingrid keeps the electricity system balanced using the electricity reserves it buys. This final and essential fine-tuning of the power grid is done at the time of use.

“Reserves are also needed to manage disturbances if one of the large power plants or cross-border connections develops a fault,” says Pia Ruokolainen, Expert at Fingrid.

For example, consumption reserves can include industrial plants or large greenhouses.

Reserves are also needed when there is too much electricity in the system and the excess electricity must be removed. This is called down-regulation, and it means reducing production or increasing consumption. This can happen if, for example, a transmission connection exporting electricity from Finland fails.

“A reserve is a controllable power plant, consumption facility or grid energy storage facility capable of increasing or decreasing its output according to the power system’s needs. For example, consumption reserves can include industrial plants or large greenhouses,” says Ruokolainen.

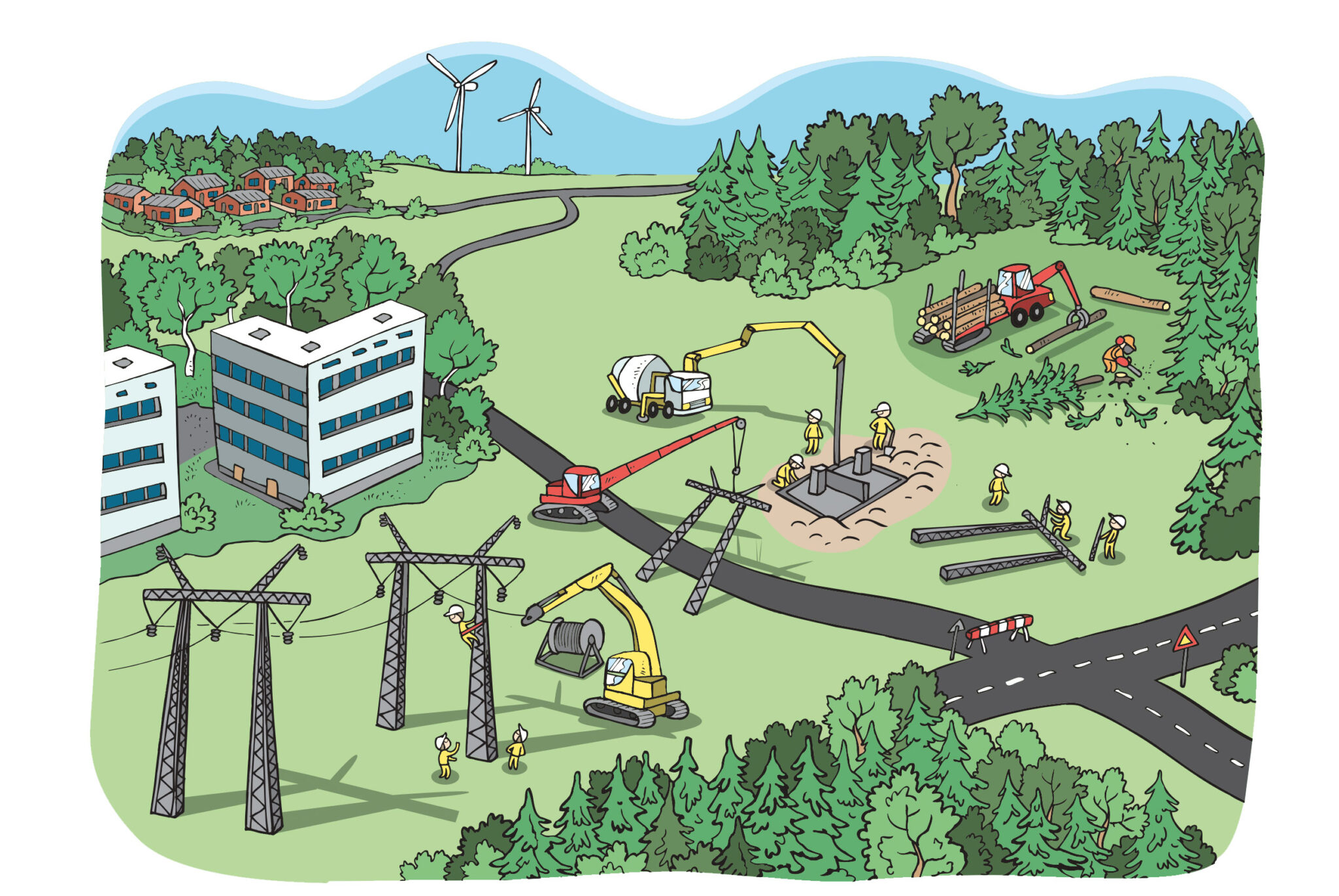

More reserves are needed all the time

Currently, approximately 70 companies participate in the reserve markets. Hydroelectric power has traditionally participated in the reserve markets, and there is still a lot of it. In addition, there are different types of electricity users, different sizes of grid energy storage facilities and other forms of production.

Although the reserve market has become busier in recent years, more reserve units are needed as the energy transition and, in particular, the growth of wind power demands more and more flexibility in the power system.

“In the past, the power system was more even. Production did not vary according to the weather, and consumption was more predictable,” says Jukka Kakkonen, Expert at Fingrid.

He says that the reserve market would welcome more wind power, consumption, batteries and solar power primarily, but that, naturally, all other types of reserves would also be good.

Reserve products with different requirements

As the balancing capacity of reserves is used for different needs and in different situations, different reserve market products are needed.

“Some products are intended to rectify disturbances, while others are used to continuously balance the grid. The fastest product has a response time of about 1 second, and the slowest is 15 minutes,” says Ruokolainen.

Reserve products are procured in their own marketplaces, and participation is a question of the producer’s or consumer’s own resources.

In total, there are five reserve products: the Fast Frequency Reserve (FFR), the Frequency Containment Reserve for Disturbances (FCR-D up- and down-regulation products separately), the Frequency Containment Reserve for Normal Operation (FCR-N), the automatic Frequency Restoration Reserve (aFRR), and balancing power and balancing capacity (mFRR reserves).

Each reserve product has its own set of rules and technical requirements, including the speed of power change.

“Different asset types fit into different reserves. For example, a battery can provide power very quickly, but it also runs out quickly. On the other hand, a hydroelectric power plant adjusts more slowly but can be kept active for a long time,” says Kakkonen.

The need for certain reserve products is increasing due to the energy transition. In other words, more resources are needed to balance the grid.

“The increase in wind and solar power reduces the power system’s natural ability to resist frequency changes, increasing the need for the fast frequency reserve in the future. In addition, it is foreseeable that more aFRR and mFRR reserves will need to be allocated to manage the power balance,” says Ruokolainen.

The need for these reserves will also depend on how well electricity market operators can balance their production and consumption in the future.

Welcome to the reserve markets!

Fingrid has improved the technical system for the reserve markets, making it compatible with all types of technologies. Fingrid has also reduced the minimum bid size for balancing bids from five megawatts to one, enabling smaller suppliers to join.

“If a plant or company has controllable production or consumption in the megawatt category, it could be a suitable candidate for the reserve market,” summarises Kakkonen.

Anyone wishing to become a balancing service provider can contact Fingrid’s experts, who will assess the unit’s suitability for various reserve markets. The facility’s reserve capability must be built and verified before joining or participating in the reserve markets.

Many reserve units can participate in several reserve markets.

Kakkonen recommends that if a company is able to maintain several types of reserves, it is worth acquiring the readiness to provide several products.

“On any given day, one reserve type could be worth more than another, so it is always good to produce the reserve that delivers the best return that day. Many reserve units can participate in several reserve markets,” says Kakkonen.

“In general, all new production plants should be designed for flexibility, as flexibility is needed in the electricity markets.”

Read more about reserve markets.

Reserve products

• FFR – THE FAST FREQUENCY RESERVE

can be activated within a few seconds and prevents the frequency of the power system from falling too far in the event of a disturbance

• FCR-D – THE FREQUENCY CONTAINMENT RESERVE FOR DISTURBANCES

can be activated within a few seconds and prevents the frequency of the power system from falling too far in the event of a disturbance

• FCR-N – THE FREQUENCY CONTAINMENT RESERVE FOR NORMAL OPERATION

continuously takes care of minor changes in the system’s balance

• AFRR – THE AUTOMATIC FREQUENCY RESTORATION RESERVE

continuously takes care of minor changes in the system’s balance based on a signal from Fingrid

• MFRR – THE MANUAL FREQUENCY RESTORATION RESERVE

continuously takes care of minor changes in the system’s balance