Congestion income arises in electricity markets when the transmission capacity between bidding areas is not enough to balance out the differences between supply and demand in the market areas. The market areas become separate price areas in which electricity buyers in one area pay a different price than the amount received by the electricity seller in the other area.

Congestion income arises in electricity markets when the transmission capacity between bidding areas is not enough to balance out the differences between supply and demand in the market areas. The market areas become separate price areas in which electricity buyers in one area pay a different price than the amount received by the electricity seller in the other area.

The price difference accrues on the power exchange in the form of congestion income, which the power exchange settles 50/50 between both transmission system operators on either side of the price areas. Agreements have been made between Finland and the Nordic countries and between Finland and Estonia to share the congestion income between the countries evenly.

Weather fluctuations and power plant shutdowns

Congestions are typically caused by the weather conditions. When Sweden and Norway are having a rainy year, there is an overcapacity in electricity generation and the price of electricity is low. At the same time, the conditions in Finland may be normal, and the price of electricity will be normal.

If the transmission capacity between Sweden and Finland is not enough to offset the imbalance between supply and demand, the price difference will give rise to congestion income for the transmission system operators in Sweden and Finland. Congestions may also arise if it is necessary to shut down a nuclear power plant or a transmission link between the market areas develops a fault.

Tariffs down or income for development

Congestion income is governed by EU law, which states that it may be used for the maintenance and development of the electricity transmission grid and for reimbursing electricity consumers for the market failure caused by the congestion; in other words, for reducing tariffs.

Network maintenance and development are necessary in order to reduce the number of market failures due to congestions, thereby evening out the price of electricity between market areas in the long run.

In an ideal situation, the transmission system operators in different market areas would operate on the same principle. In such a case, the transmission capacity would be improved on both sides of the border. This would be an effective way of eliminating congestions.

“It is important for us to have clear rules about how congestion income is used. The logic is that the congestions will be addressed. In practice, the transmission system operators receive money in order to rectify the market failures by investing in network development,” says Jussi Jyrinsalo, Senior Vice President, Grid Services and Planning, at Fingrid.

Fingrid invests in the network

When Fingrid is planning to use congestion income for investments, it must first seek the Energy Authority’s approval.

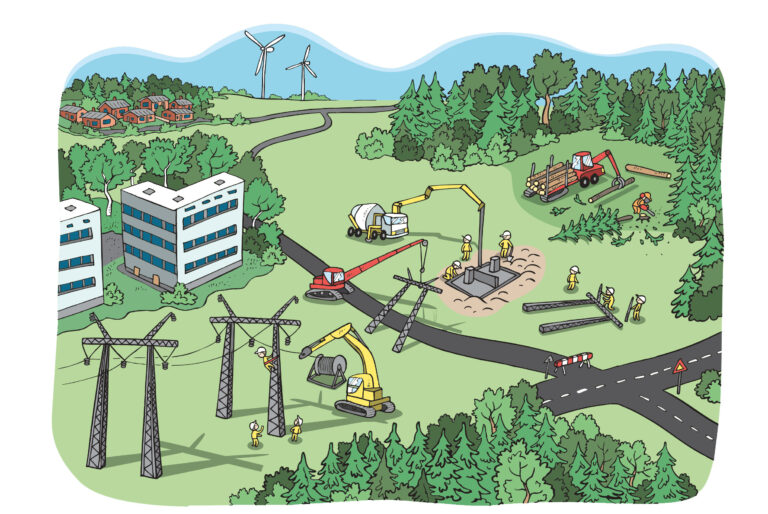

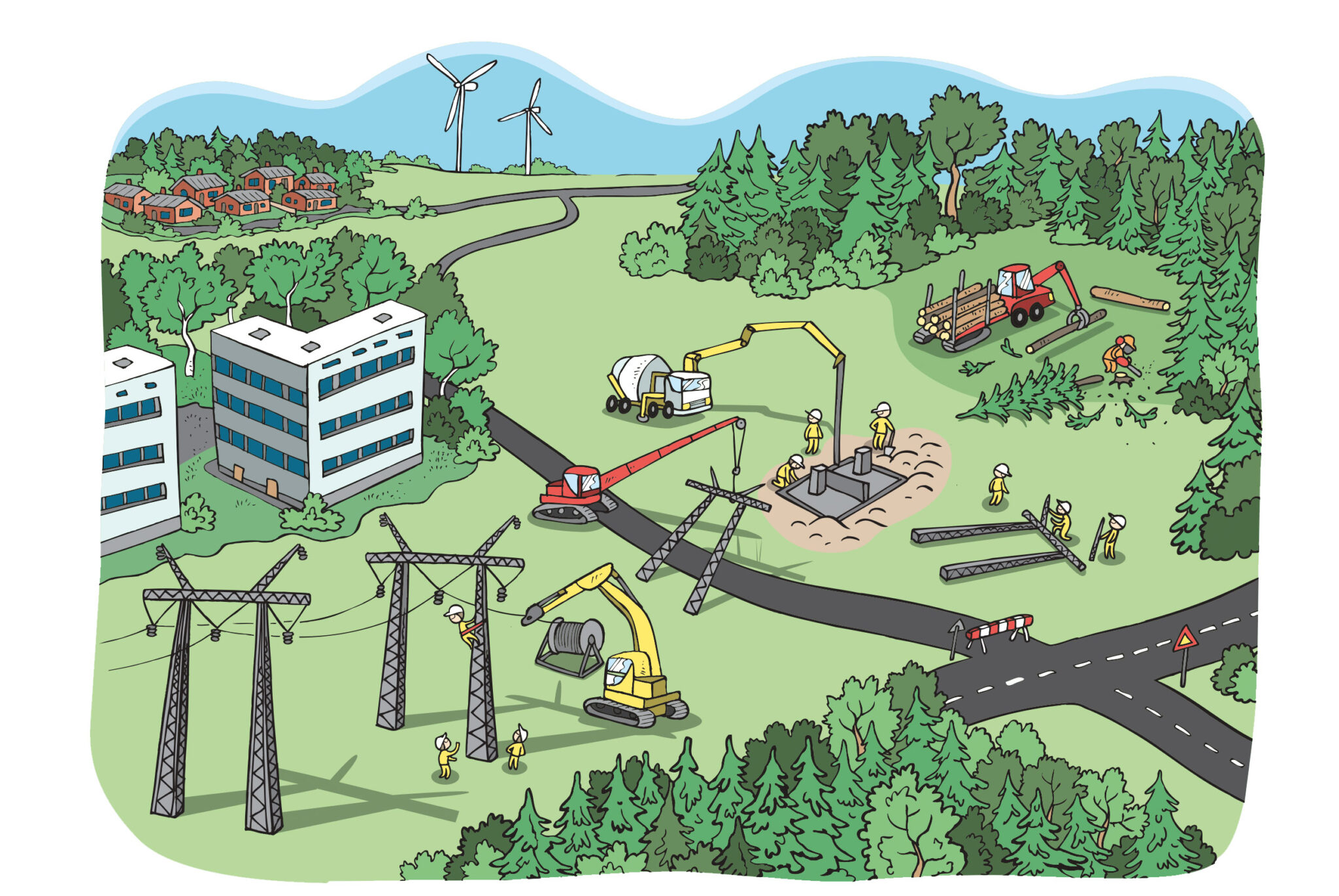

At present, Fingrid is making major investments in several projects, which include building the Forest Line, a transmission line linking the north and south of Finland, and increasing the transmission capacity towards Sweden in the Tornio river valley.

“Congestion income is excess income for transmission system operators, and it describes a deficit in the markets. For this reason, congestion income should be used to minimise this deficiency,” says Jarno Lamponen, Leading Specialist at the Energy Authority.

In Sweden, not all of the congestion income is spent on investments to eliminate the congestions they originated from. Instead, some of it is used for other projects. Jyrinsalo from Fingrid would like the congestion income to be used symmetrically on both sides of the border.

Hundreds of millions in 20 years

Fingrid’s congestion income has averaged EUR 20–30 million this millennium, with a peak of EUR 90 million. This money has been spent on market-oriented network development: securing the availability of electricity for Finnish people and ensuring that the price of electricity remains reasonable under all conditions.

“Significant sums of money are required to improve and strengthen the network to enable the energy revolution,” says Jyrinsalo.

Spending the congestion income on strengthening the network is one aspect of Fingrid’s corporate responsibility – it is making investments in reducing market failures.

Fingrid uses market simulation models to forecast its congestion income and estimate how much of its investment expenditure will be covered.

“The congestion income is a natural consequence of the current market model. If there were no congestion income, we would be in the position of having invested too much in the grid,” Lamponen says.