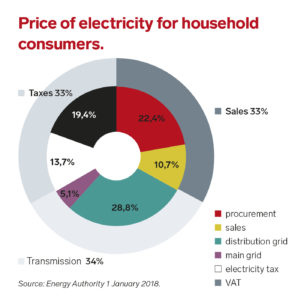

The price of electricity consists of sales, transmission and taxes

A study by the Finnish Energy Authority shows that the price households pay for electricity consists of three nearly equal parts: sales, transmission and taxes. The transmission of electricity through the main grid, which is handled by Fingrid, only accounts for 5% of the total cost to the consumer.

Statistics from 2017 show that Finnish consumers pay an average price of 16.42 cents per kilowatt hour of electricity. Calculated from this figure, the price of main grid transmission is approximately 0.8 cents per kilowatt hour. The largest  portion – about 29% or just under 5 cents of the kilowatt hour price – is invoiced by the distribution system operator, which transmits electricity to the consumer. A European comparison reveals that Finland’s electricity prices are clearly lower than average.

portion – about 29% or just under 5 cents of the kilowatt hour price – is invoiced by the distribution system operator, which transmits electricity to the consumer. A European comparison reveals that Finland’s electricity prices are clearly lower than average.

According to the report, a household user’s average electricity consumption is about 5,000 kilowatt hours per year, but a household that uses electricity for heating has to be prepared for annual consumption of approximately 18,000 kilowatt hours.

The Finnish Energy Authority’s report also indicates that the development history for distribution tariffs in 2000–2017 shows a trend of increasing fixed costs. Customer groups that use small amounts of electricity have seen the steepest increases in fixed costs. In 2017, a consumer paid about 20 euros more for electricity than one year earlier.

The legislation that took effect in 2017 specifies a ceiling for price increases. The grid owner can raise grid service fees by a maximum of 15% in comparison to the price level during the previous 12-month period.

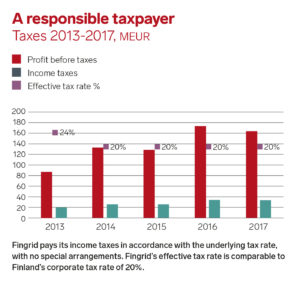

A responsible corporate taxpayer

Fingrid paid approximately 33,2 million euros in taxes in 2017. Fingrid pays taxes and dividends to Finland. Fingrid is ranked quite high – 17th position – on Finland’s euro-denominated list of corporate taxpayers.

The company pays its income taxes in accordance with the underlying tax rate, with no special arrangements. Fingrid’s  effective tax rate is comparable to Finland’s corporate tax rate of 20%.

effective tax rate is comparable to Finland’s corporate tax rate of 20%.

According to Fingrid’s strategy, the company’s financial management begins with the premise that we respond to the expectations of society in the long term, we operate cost-effectively and we provide value to our owners. Strong development is another element of efficiency, productivity and responsibility – Fingrid wants to be a forerunner in transmission system operation on the increasingly international electricity market,

One sign of our success in this area is the high rankings achieved in international studies. In terms of price, Fingrid has been one of the most reasonably priced European transmission system operators for a long time.