1. What is the balance service fee?

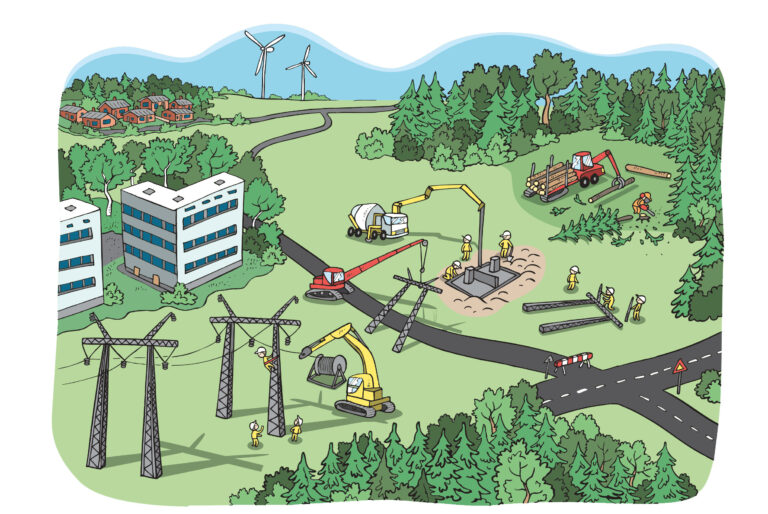

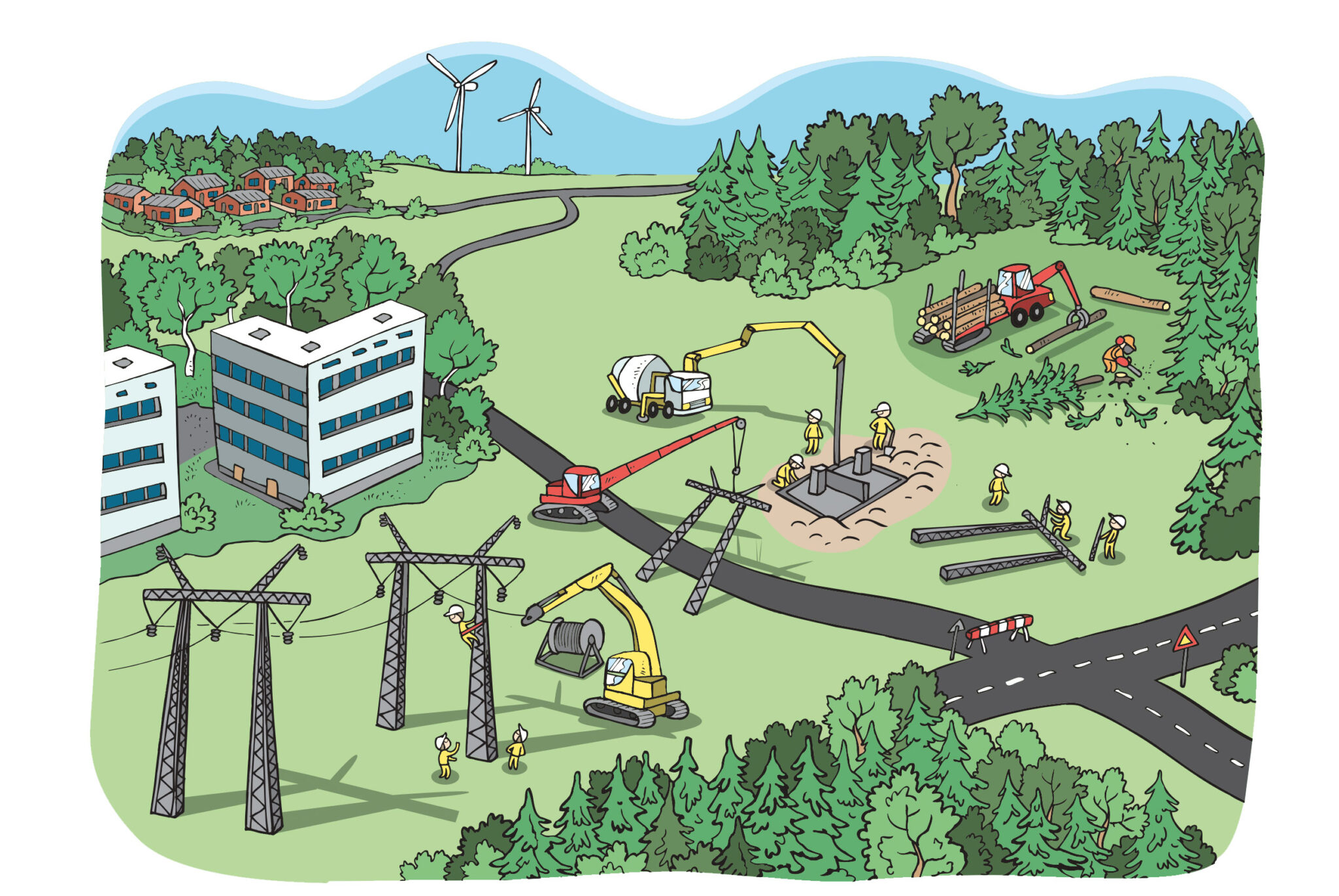

Fingrid purchases reserves on the reserve market in order to keep electricity production and consumption in balance and maintain the frequency and system security of the power system.

Fingrid covers the cost of some of these reserve purchases by charging main grid tariffs. And part is covered with the balance service fees that Fingrid charges to balance responsible parties, for whom reserves represent the largest cost to cover.

These balance service fees cover the costs of purchasing frequency containment reserves, which are used to counterbalance the normal fluctuations in production and consumption, as well as automatic frequency restoration reserves.

2. Why have balance service fees risen?

The main reason is that it has become more expensive to purchase reserves – even more rapidly than anticipated in recent times.

Trading in Russian reserves has been halted, and uncertainty prevails in the electricity market. In addition, the introduction of the pan-Nordic market for automatic frequency restoration reserves has been postponed. All of this has resulted in higher prices for electricity and reserves.

3. What does the future hold for balance service fees?

In the coming years, we predict that the need to purchase reserves will continue to rise due to the energy transition and changes in the Nordic balance management. Demand for fast frequency reserves and frequency restoration reserves will increase, which will also affect costs. Fingrid welcomes new suppliers to

the reserve market.

4. How often does Fingrid review its balance service fees?

Balance service fees are valid until further notice. Balance service fees and balance service costs are constantly monitored and the fees are updated to cover the costs of the operation.

5. How is Fingrid developing reserve markets?

We removed the 35-megawatt limit applying to purchases of automatic restoration reserves from Estonia in June 2022. We are developing Nordic and European marketplaces, and we intend to facilitate aggregation, redesign the electricity capacity market from weekly to hourly purchases, and explore the opportunities for longer-term reserve agreements.