What is the intraday market all about?

“Intraday trading refers to electricity trading close to the delivery of the product. It allows market players to balance their electricity production and consumption closer to real-time and to support the balancing of the power system,” explains Special Advisor Heini Ruohosenmaa from Fingrid.

“Trading is continuous during every hour of the day.”

The intraday market for continuous trading between Finland and Sweden was the first of its kind in the world. Ruohosenmaa says that the market initially expanded regionally.

“Eastern Denmark joined the system in 2004 and Germany in 2006. They were followed by western Denmark in 2007, Norway in 2009 and the Baltic countries a little later,” continues Ruohosenmaa.

“The Finnish–Swedish system was also used as an example for the target model for a European electricity market.

XBID is the next step

XBID (Cross-Border Intraday Market) was launched in June 2018 as part of the implementation of the European target model for intraday trading. The common European intraday market currently comprises 14 countries: Netherlands, Belgium, Spain, Austria, Latvia, Lithuania, Norway, Portugal, France, Sweden, Germany, Finland, Denmark and Estonia.

“After the marketplace expands regionally, it will be possible to trade throughout Europe,” says Ruohosenmaa and adds that the next wave will bring in more countries from Eastern Europe.

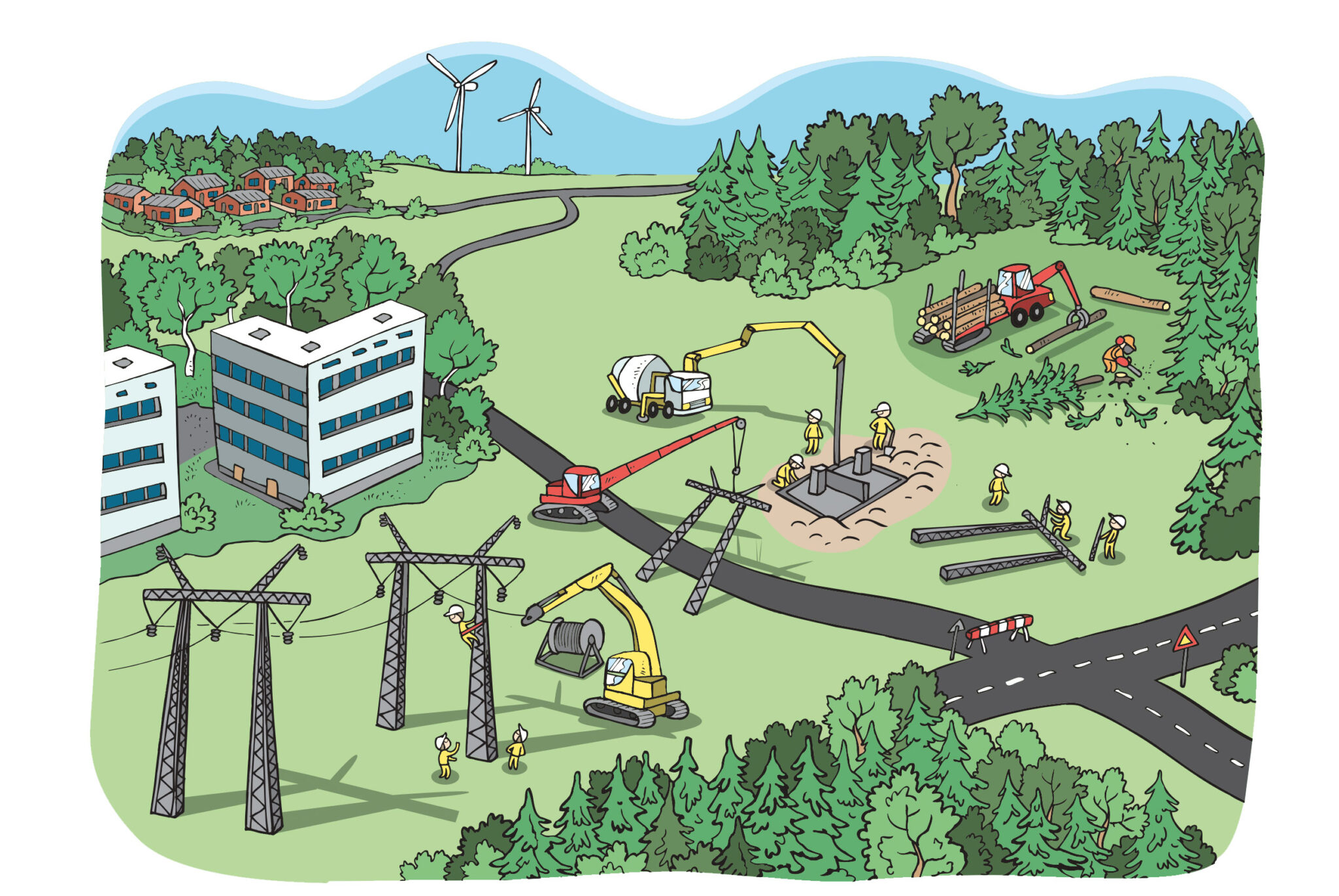

The importance of the intraday market is likely to grow in the future as the amount of variable production (such as wind and solar power) increases.

“The biggest change over the past 20 years has probably been the introduction of renewables to the market. For example, wind and solar power producers have difficulty forecasting accurate production volumes in advance, so trading in nearly real time is a welcome and necessary option for them.”

Fingrid’s aim is to promote market-based solutions and possibilities to trade closer to the time of delivery.

“Real-time trading is definitely the direction we’re moving in,” confirms Ruohosenmaa.